Medicare Tax Brackets 2024 Chart – What taxes will you owe on your capital gains? With a big year in the stock market in 2023 you could be facing a large tax bill. . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

Medicare Tax Brackets 2024 Chart

Source : thecollegeinvestor.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Medicare Cost | Medicare Costs 2024 | Costs of Medicare Part A & B

Source : boomerbenefits.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

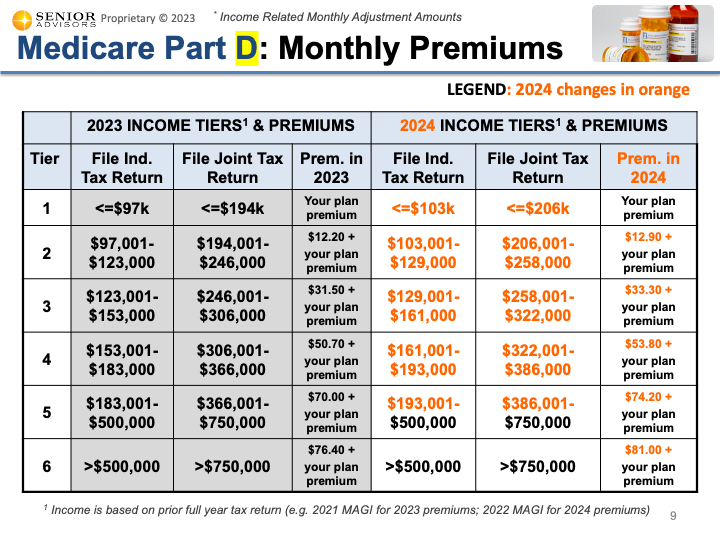

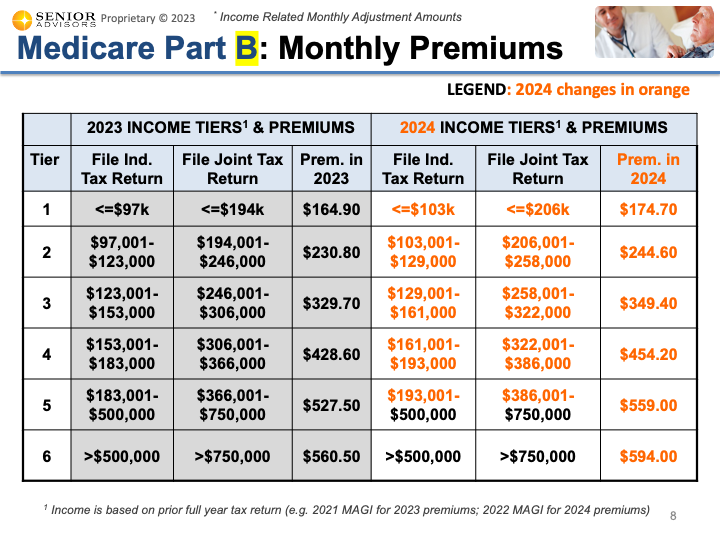

Medicare Blog: Moorestown, Cranford NJ

Source : www.senior-advisors.com

Why Filing Taxes Separately Could Be A Big Mistake (when on

Source : www.medicaremindset.com

Medicare Blog: Moorestown, Cranford NJ

Source : www.senior-advisors.com

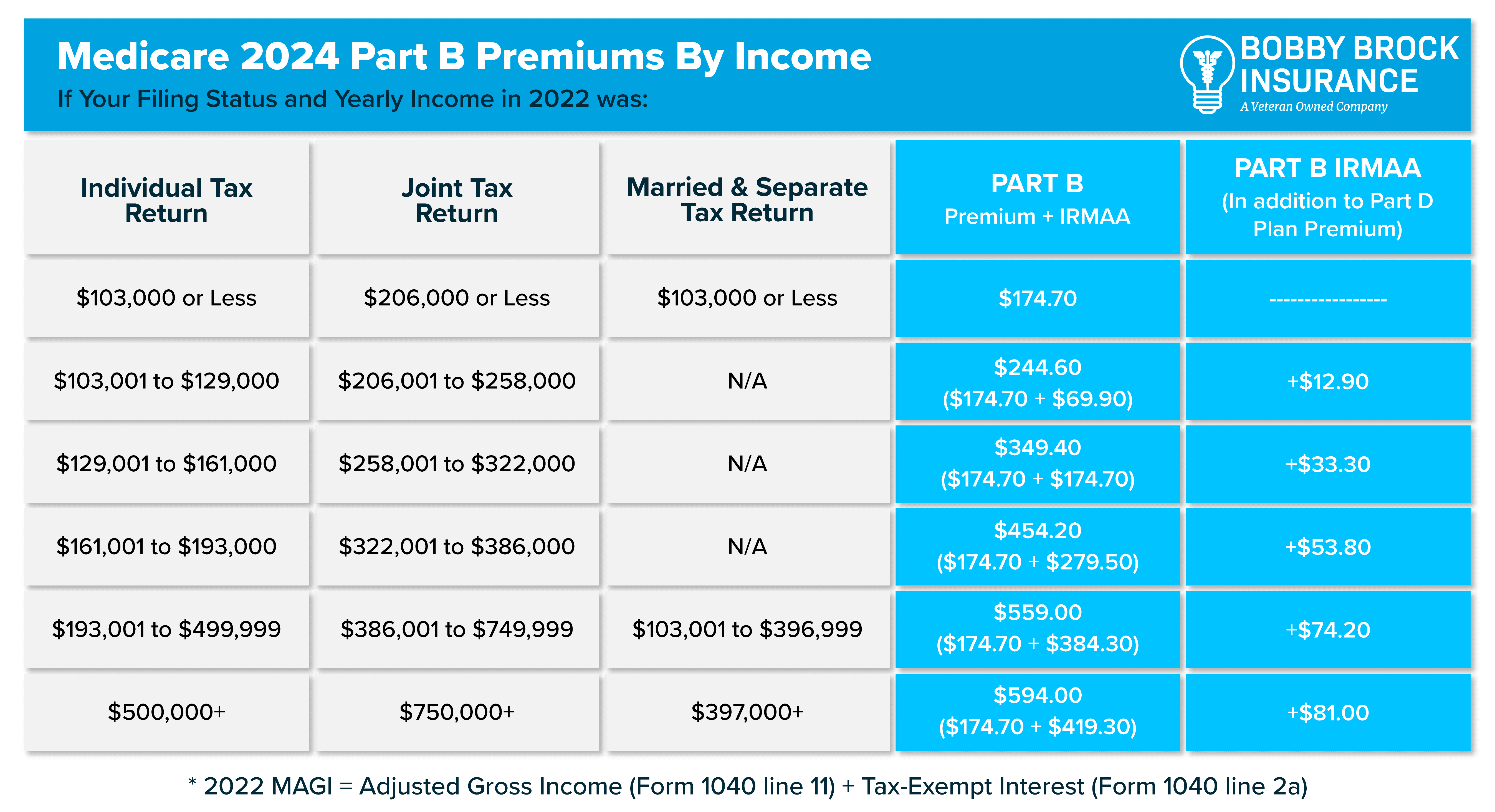

Your Guide to 2024 Medicare Part A and Part B | BBI

Source : bobbybrockinsurance.com

How Tax Brackets Work [2024 Tax Brackets] | White Coat Investor

Source : www.whitecoatinvestor.com

Medicare Tax Brackets 2024 Chart Federal Tax Income Brackets For 2023 And 2024: As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates. A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. . Both federal income tax brackets and the standard deduction have increased for 2024. This change is in response to sticky inflation, which has kept prices high all year. The higher amounts will .